what is fit tax on paycheck

Knowing what is. Payroll tax withholdings are made in accordance with the following rules.

Calculation Of Federal Employment Taxes Payroll Services

Paying taxes is on everyones mind rarely in a good way.

/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

. The Federal Income Tax is progressive so the amount will vary based on the projected annual income paid by that employer to you. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status. TDI probably is some sort of state-level disability insurance payment.

The employees adjusted gross pay for the pay period. The federal government is entitled to a portion of your income from every paycheck. These taxes fall into two groups.

Also known as payroll taxes FICA taxes are automatically deducted from your paycheckYour company sends the money along with its. Purchase-Related Transactions Using Perpetual Inventory System Instructions The following selected. What is the fit tax on my paycheck.

A copy of the tax tables from the IRS in Publication 15. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. These items go on your income tax return as payments against your income tax liability.

Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. Federal income tax is the on which is payable for the wages earned for a particular period and can. The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may.

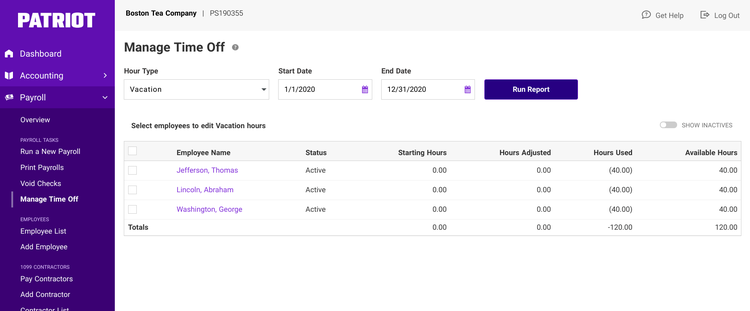

Fit is the amount required by law for employers to withhold from wages to pay taxes. Federal income tax fit federal income tax fit is withheld from employee earnings each payroll. Calculate Federal Income Tax FIT Withholding Amount.

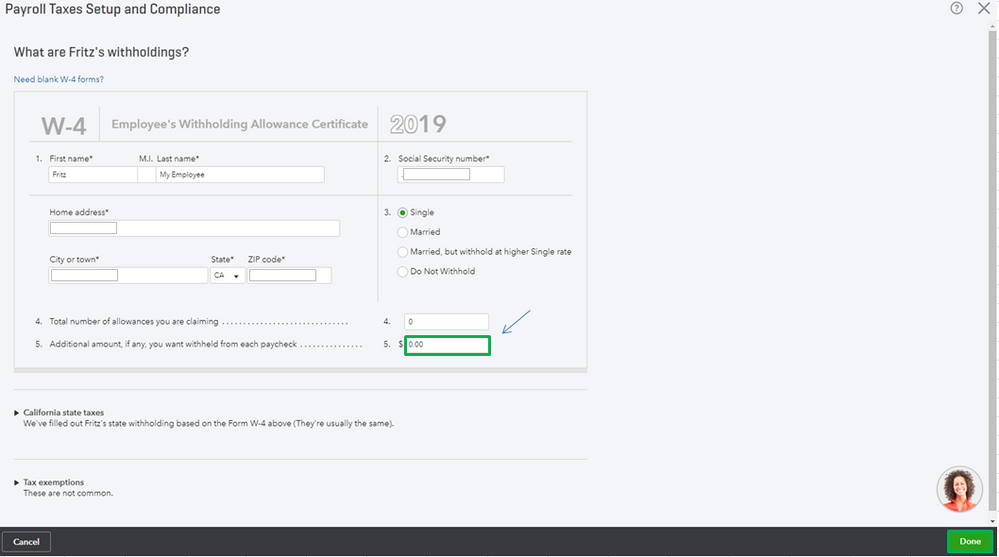

Mandatory Payroll Tax Deductions. Payroll taxes are considered liabilities until the end of the fiscal year when they must be transferred to federal state and local governments. To calculate Federal Income Tax withholding you will need.

Not to be confused with the federal income tax FICA taxes fund the Social Security and Medicare programs. The employees W-4 form and. The information you give your employer on Form W4.

Jean and Dan both work. The amount you earn. All wages salaries cash gifts from employers business income tips gambling income bonuses and unemployment benefits are subject to a federal income tax.

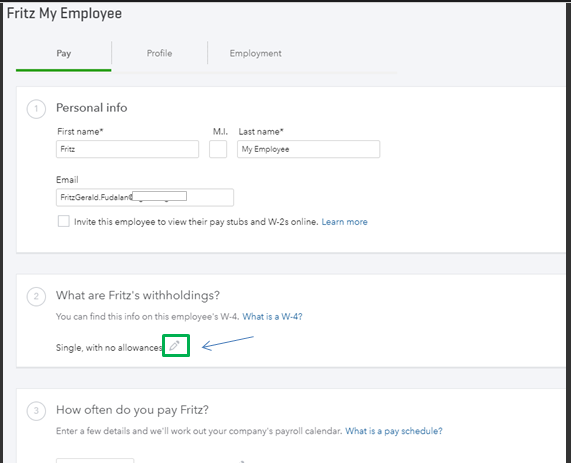

All of the employees withholdings are affected by the employees income and filing status married. FIT Fed Income Tax SIT State Income Tax. However FUTA is paid solely by employers.

Each earns a salary of 48500 but only Jean is a member of a registered. The federal income tax is the largest source of revenue for the federal government. Federal income taxes or FIT is calculated on an employees earnings including regular pay bonuses commissions or other types of taxable earnings.

The amount earned gross pay pay frequency. This is known as your withholding tax a partial payment of your annual income taxes that gets sent directly to the government. Both Social Security and Medicare taxes are fixed-rate taxes you withhold from your employees wages and pay on behalf of your employees.

Federal Income Tax FIT and Federal Insurance Contributions Act FICA. Answer 1 of 2. All salaries cash gifts wages from business income gambling income employers tips unemployment benefits and bonuses are focused on a tax of federal income.

Federal taxes are the taxes withheld from employee paychecks. For most people FIT are the taxes that employers are expected to withhold from your paycheck. Some are income tax withholding.

The major cradle of income for the federal administration is the federal income. These two taxes aka FICA taxes. Paying social security taxes on earnings after full.

Your net income gets calculated by removing all the deductions. For employees there isnt a one-size-fits-all answer to. FIT stands for federal income tax.

FICA taxes are payroll taxes and they are. FIT tax refers to Federal Income Tax. For employees withholding is the amount of federal income tax withheld from your paycheck.

The FIT is a form of tax on yearly incomes for businesses individuals and additional lawful entities. If you earn a wage or a salary youre likely subject to Federal Insurance Contributions Act taxes. Make sure you have the table for the correct year.

On your paycheck it will show how much your federal income taxes are under the term federal withholding. Medicare is 145 for both employee and employer totaling a tax of 29. The amount of income tax your employer withholds from your regular pay depends on two things.

Secondly what are the required deductions from your paycheck. For help with your withholding you may use the Tax Withholding. Social Security is 62 for both employee and employer for a total of 124.

Federal Unemployment Tax Act FUTA is another type of tax withheld. On every paycheck employers have the obligation to withhold and remit to the government the federal income taxes owed by their employees. The federal income tax is a tax on annual earnings for individuals businesses and other legal entities.

The rate is not the same for every taxpayer. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. On a pay stub this tax is abbreviated SIT which stands for state income tax.

Income taxes are taxes on income both earned salaries wages tips commissions and unearned interest dividends. Federal income tax rates range from 10 up to a top marginal rate of 37. The following taxes and deductions are what you can expect to see on your paycheck explained in detail below.

FIT is applied to taxpayers for all of their taxable income during the year. Fit stands for Federal Income Tax Withheld.

The 3 Tax Numbers Employees Must Know In 2022

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

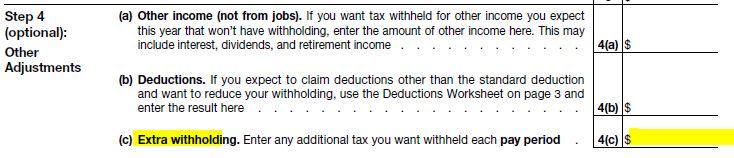

Additional Federal Withholding

Digital Budget Planner Biweekly Paycheck Edition Lag Free Undated Digital Planner Budget Doctor Budget Planner Budgeting Finance Tracker

/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

Additional Federal Withholding

/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

What Is Payroll Accounting Definition And Examples Bookstime

Quickbooks Desktop Calculates Wages And Or Payroll Taxes Incorrectly

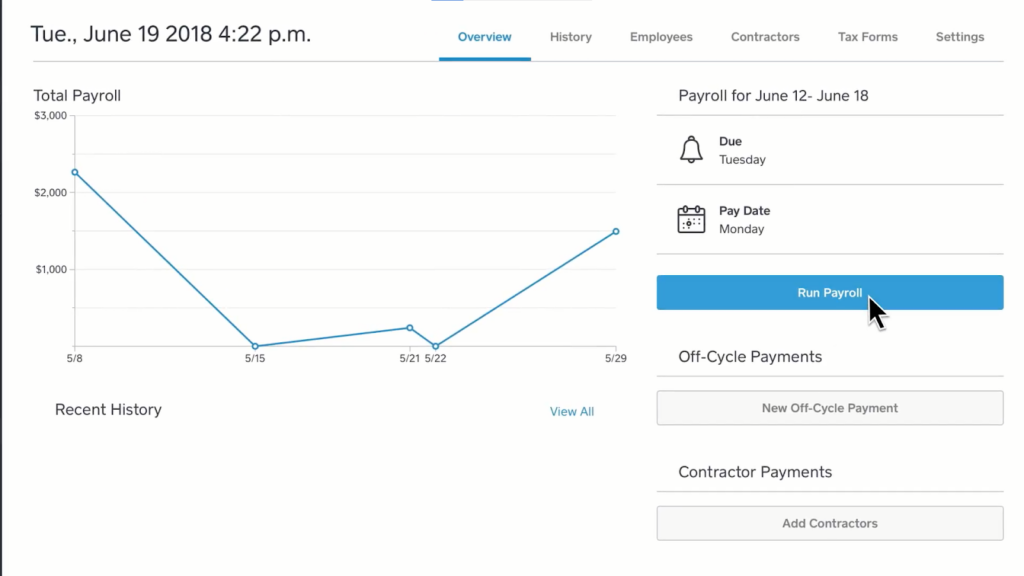

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

How To Calculate Taxable Wages A 2022 Guide

Calculation Of Federal Employment Taxes Payroll Services

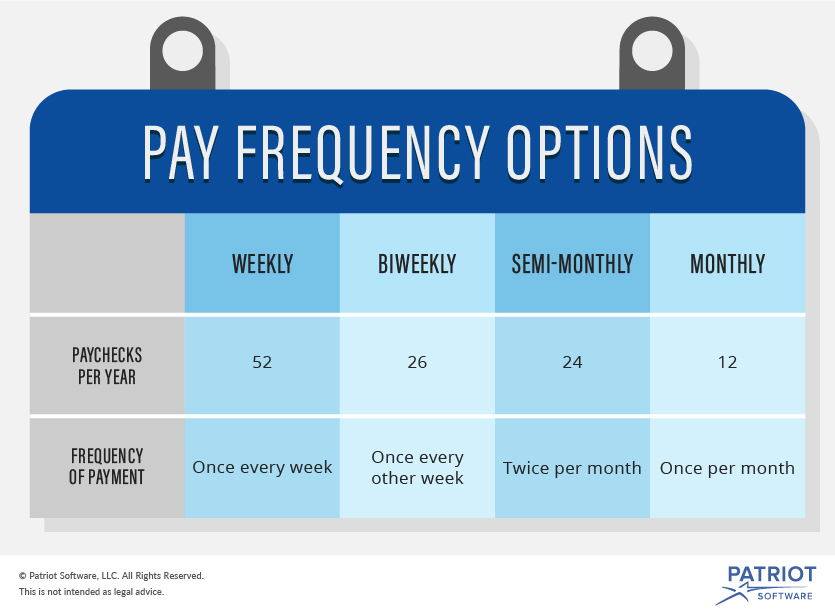

What Does Pay Frequency Mean How Often To Pay Your Employees